Buying a home can be tough, and if it’s your first time it can feel downright overwhelming. We get it, and we’re here to help you through every part of it. We’ve compiled a handy little first-time homebuyer’s guide that runs down what you’ll need to get your ducks in a row.

What are my financing options?

There are many different loan types and lenders to consider, and it’s worth your time to shop around and find the right loan for you. We’ve laid out a brief description of each kind to help you understand which option meets your long and short-term goals, so you will know how to identify the best deal. Every loan consists of three main yet distinctive factors; rate, type, and size. Here is a brief overview for each.

Fixed Rate or Adjustable Rate:

All loans will fit into one of these two categories, but a hybrid option is also available. The “rate” in question is the interest paid on the life of the loan. It can either be “fixed” and never change or “adjustable,” wherein the rate changes yearly or after a set number of years (thus making it a hybrid).

Government-Insured or Conventional loan:

In addition to deciding between a fixed rate, adjustable rate or a combination of the two, you’ll also need to decide if you want your loan to be insured and guaranteed by the federal government or not. Of the government-insured options, there is the FHA, the VA, and the USDA. Each is tailored to meet specific needs and have different advantages.

Jumbo or Conforming loan:

These terms describe the size of your loan based on criteria set by Fannie Mae and Freddie Mac. Jumbo loans are considered a higher risk for lenders and often come with additional requirements.

Should I buy a used home or a new home?

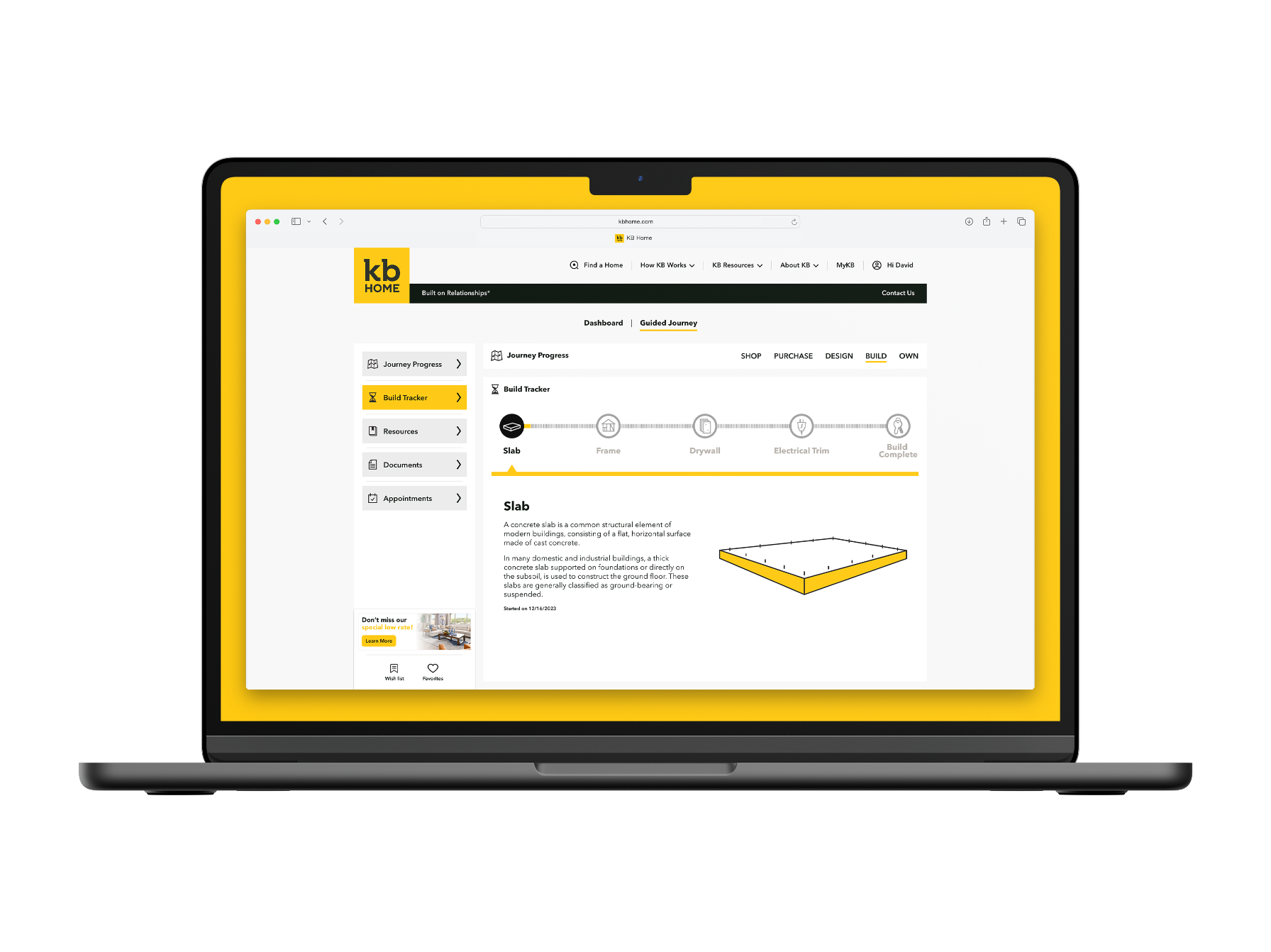

Option 1: Build a new home personalized for you

You may have always thought building a personalized home was out of the question. But KB Home has made it accessible and affordable. A new home lets you make your home your own, letting you choose the community and homesite you want to live in and add your own unique design touches. Our homes also come with open floor plans and spacious living areas personalized to your specific needs. And all of our homes are highly energy efficient to help save you money, built with modern materials not found in old homes. Finally, you’ll get a 10-year limited warranty on your new home, so if you run into any problems down the line we’ll be back to help.

Option 2: Buy a used home

Although a “fixer-upper” might sound appealing, older homes can take extra work in regard to maintenance and repairs. Some people may be drawn to the idea of being able to move in immediately, but remember, that may come with a significant host of possible issues: older building materials and appliances, greater risk of leaks and drafts, the inability to tailor your home to your needs, and an overall less energy-efficient home. Used homes will often cost less per square foot than a new home, but updating for energy efficiency or more modern features can become costly. It may be worth considering a new home to save yourself money and headaches down the line.

How should I prepare for my home search?

Before you begin your home search, you’ll want to create a list that prioritizes “must-haves,” “nice-to-haves,” “neutral,” and “absolute nos.” This list will allow you to organize the criteria you’ll place on each home in your search and help you compare your findings. It’s also important to understand that as you go through the process, the list will likely evolve as your preferences change. Here are a few things to consider.

Space:

Think about what space you’ll need now and in your future. It may be based on the next five or 10 years, or it may be based on your phase of life. Are you newlyweds, starting a family, combining families or empty nesters? How big does your house need to be to accommodate the future?

Features:

Make a list of what your perfect home will provide you and your family. Do you need a two-car garage? Do you need a fenced-in yard for your fur babies? Will you need railings or ramps for a family member with a disability?

Energy efficiency:

Many first-time homebuyers don’t realize the effect higher utility bills will have on their monthly budget. Larger houses will take more energy, and older homes can too if they haven’t been updated. Our homes are all designed to be ENERGY STAR® certified, meaning they meet certain energy-saving requirements that help save you money. Make a list of any additional energy-efficient features you might want, including appliances, solar paneling, or high-efficiency water heaters.

Schools:

Depending on your stage of life or future needs, this is important for many families. Whether working with an agent or searching for homes online, school district zones are readily available. A quick online search may be worth it to compare public and private schools, and even some day cares in your area.

Commute times & local transportation:

Do you drive to work, take a bus, participate in a rideshare program or take the train? Your home’s accessibility to these options is important.

Community & Neighborhood:

There are many community features to consider—pools, clubhouses, playgrounds, parks, and more. Think about the type of neighborhood and community you want to be a part of. How close do you want to be to your local gas station, grocery store, post office, emergency services and hospital? Nightlife, fitness centers, shopping and restaurants also become key factors to consider. Both your home and neighborhood should meet your lifestyle, so write these details down.

You’re ready to start searching!

No matter the path you choose to finding your home, prioritizing your needs and wants will quickly become second nature the more homes you view and visit. It’s a lot to consider, but before you know it, you’ll be unpacking boxes and settling in.